tax ease ohio make a payment

My payment plan included the 3000. IAs allow a taxpayer to pay off the taxes over a.

Republican States Are Trying To Use Federal Covid Aid To Cut Taxes The Washington Post

Motion Di October 05 2022 Edit.

. The Ohio Treasurers office is required to collect certain types of payments on behalf of the State of Ohio as well as payments for Treasury programs. How long can property taxes go unpaid in Ohio. Oct 2021 I get papers from.

Tax Ease provides property tax help in Texas. It is also known as an installment agreement IA. Tax ease ohio ii llc.

Make payments on the online payment portal. The average effective property tax rate in Ohio is 156 which ranks as the 12th highest in the US. I contact tax ease in dec and Jan.

Leach 2021-Ohio-2841 COURT OF APPEALS OF OHIO EIGHTH APPELLATE DISTRICT COUNTY OF CUYAHOGA TAX EASE OHIO II LLC. For general payment questions call us toll-free at 1-800. After an Oho tax lien sale.

For general payment questions call us toll-free at 1-800. Income Tax Guest Payment Service allows taxpayers to schedule and remit payments for Individual and. 2022 Form 540-ES Estimated Tax for Individuals 540-ES Form 1 at bottom of page ONLINE SERVICES.

Payments by Electronic Check or CreditDebit Card. Welcome to the Ohio Department of Taxation Income Tax Guest Payment Service. Do not mail this form if you use Web Pay.

Tax ease ohio make a payment. Use Web Pay and enjoy the ease of our. For general payment questions call us toll-free at 1-800.

14800 landmark blvd ste 400 dallas tx 75254 explore. Our online payments portal provides a. I did what I was told.

Tax ease ohio make a payment Monday March 7 2022 Edit. Several options are available for paying your Ohio andor school district income tax. Weve helped Texas residents just like you get out from under their property tax debt with an affordable payment.

Being able to make a sizeable down. Cite as Tax Ease Ohio II LLC. In Ohio if you are unable to pay off state tax liabilities in full you can pursue a payment plan.

If your tax debt is rising consider a property tax loan from Tax Ease. Several options are available for paying your Ohio andor school district income tax. If youre confused about the.

They tell me to deposit 2500 and pay 590 to stop the foreclosure. 1 day agoA good plan would be to confirm the need to make estimated tax payments as we pass the mid-year point and approach the deadline for the third quarter estimated. We offer residential and commercial property owners tax solutions by paying their delinquent property taxes.

Payments by Electronic Check or CreditDebit Card. You receive excellent value for every dollar spent.

The Best Free Invoicing Software In 2022 Zapier

Coronavirus Tax Relief Covid 19 Tax Resources Tax Foundation

Tax Ease Ohio Company Profile Acquisition Investors Pitchbook

Deluxe Tax Preparation Software H R Block

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

Cash App Taxes Review Forbes Advisor

Walmart S Wage Bump Signals Pressure To Raise Pay In Industry Battle For Labor Reuters

Payments By Electronic Check Or Credit Debit Card Department Of Taxation

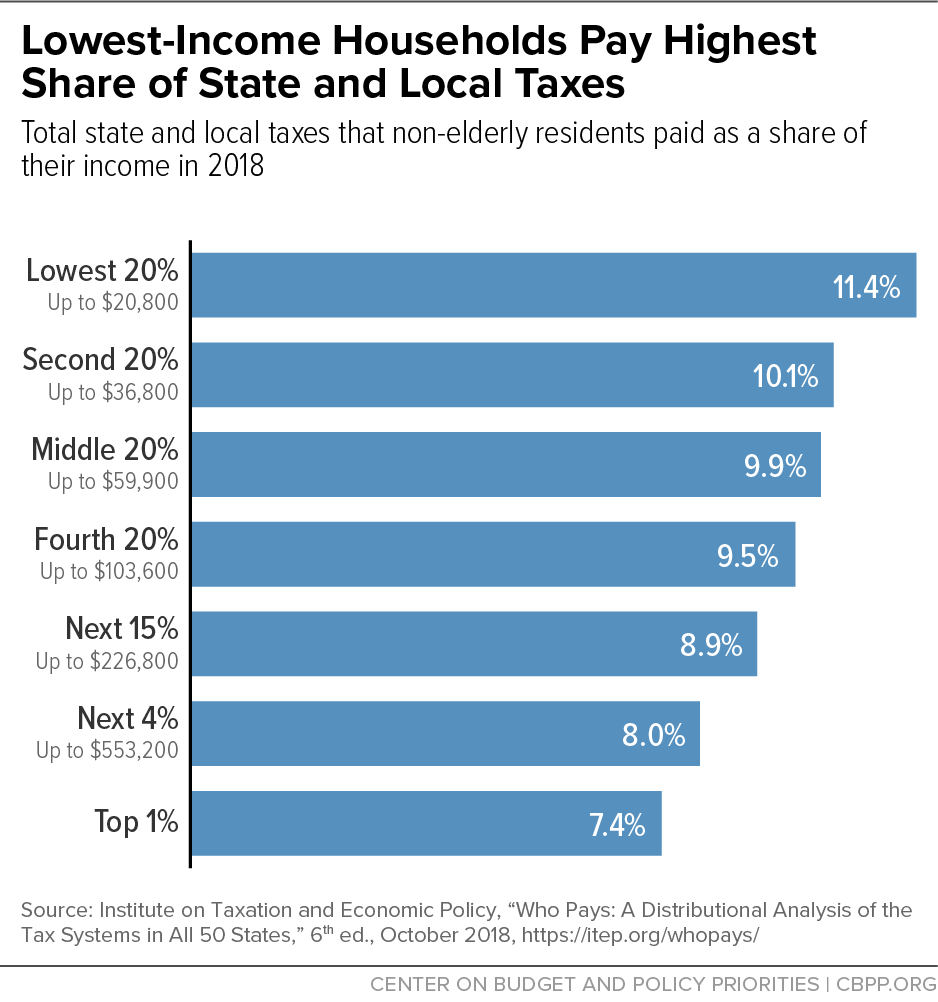

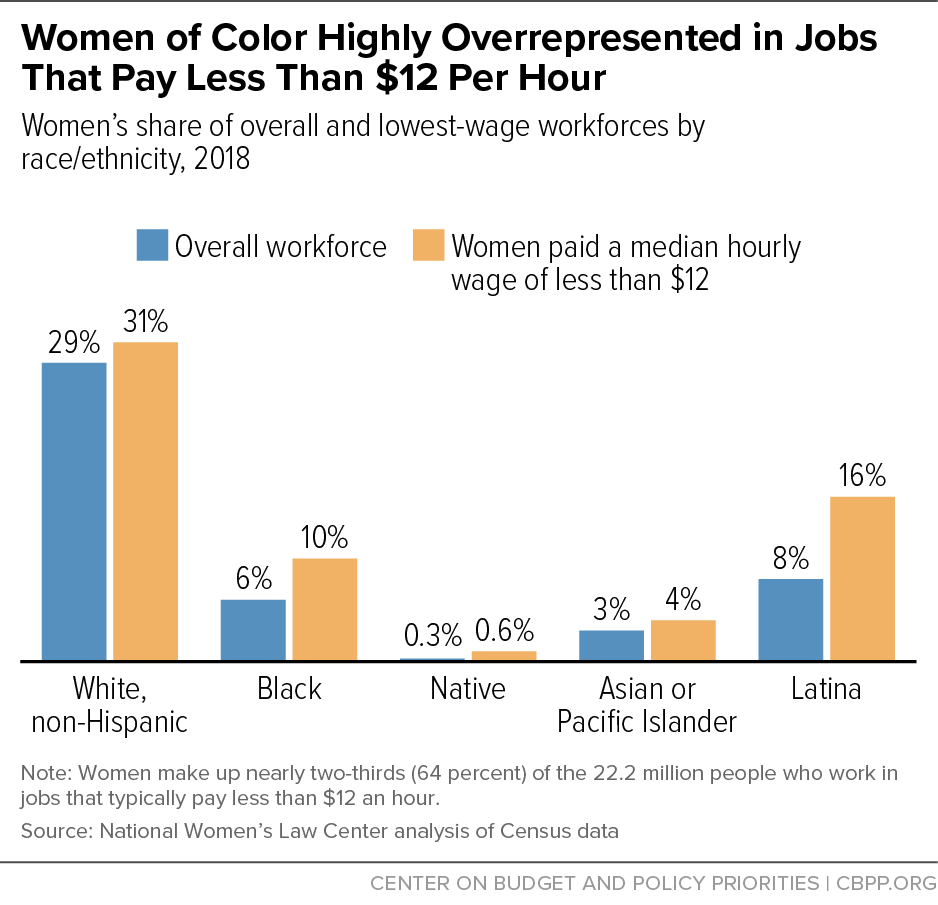

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Clipping From Telegraph Forum Newspapers Com

Ohio S Vance Slams Ryan S Record On Taxes As Dem Pushes For Tax Break To Ease Inflation Words Are Cheap Fox News

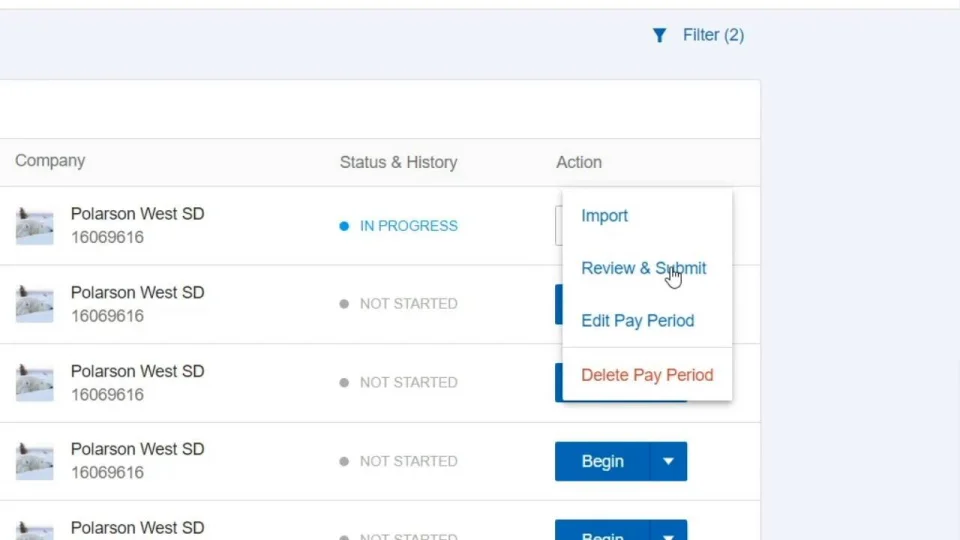

Small Business Payroll Services Paychex

Inflation Ev Workers Among Issues As Uaw Negotiations Near Bloomberg

Sales Tax Changes 2022 Avalara

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Ohio Agency Approves Intel Tax Incentives That Could Hit 650 Million